ITR ONLINE

ITR Filing in Ludhiana, SK Tax Law Firm is distinguished as the prime service provider engaged in offering service. These tax return consultants in Ludhiana service are rendered by professionals. In addition to this, these income tax return filing in Ludhiana services are executed at industry- leading rates to provide optimum customer satisfaction. By applying advanced technology in this Income Tax Consultant in Ludhiana services, we cater to the client's requirements. Also, our CA utilizes advanced technicians in rendering income tax return filing services in Ludhiana to enhance special emphasis on superior quality. We are offering these tax return filing agents in Ludhiana services as per the latest ITR norms. In addition to this, we have gained a vast clientele base by executing these Income Tax Filing services in Ludhiana under the minimum stipulated time. Apart from this, owing to its pocket-friendly price, and perfect work, this Income Tax e-filing in Ludhiana service is valued by our honored clients.

An income tax return is a form where taxpayers report their taxable income, deductions, and tax amounts. This method of filing income tax returns is connected to income tax filing. Income tax is levied on the income of all the salaried people. Its provisions are administered by the income tax department wherein the tax is received by the central government of India. The central board of direct taxes recommends the format for filing the returns by various conditions. The general conditions for furnishing the return are particulars of income earned under the various head, gross income, and deductions from gross total income, total income, and tax payable. Taxpayers should mandatorily file their income tax returns. As the returns are filed electronically, there is no requirement for any hard copies of documents like TDS certificates, and investment proofs.

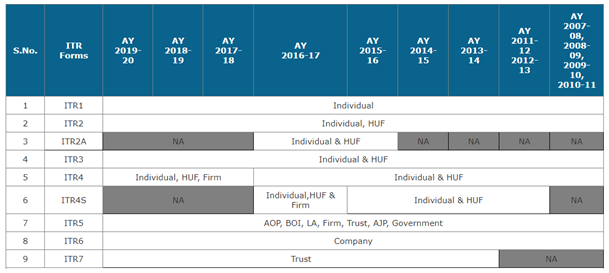

If you have spent more tax than needed for the financial year, the government IT department will refund the extra money to your account. If you have underpaid taxes for the year, kindly pay the resting amount, and then file your income tax returns. Income tax return form varies from ITR 1 to ITR 7, used for different types of income. Some forms are needed additional disclosures like a balance sheet and a profit and loss statement report. For this, you need an expert to file the income tax. SK Tax Law Firm helps you in this online tax return filing process with the support of experienced professionals.

If you are an Indian or NRI, e filing of income tax return is mandatory. Even if you do not reach the threshold limit, it is a good practice to e-file your income tax return. An income tax return is the main document that you have to provide at the time of availing a loan, as it shows your financial discipline and prosperity as well as displays your capability to repay a loan. If you are preparing to go abroad for higher studies, or are about to take up a job outside of India, you will require at least three years of filed income tax returns to record as proof of income. People processing your visa request may request your ITR documents to estimate your financial health, which in return notes that you can support yourself on your own in their country.

Once ITR is filed, an acknowledgment slip in duplicate is issued which consists of details like:

The following documents are necessary for income tax filing:

For Business: The IT Department of India has rules for all businesses operating throughout the country to file income taxes every year. If must be, a TDS return can also be filed and advance taxes can be paid to guarantee that the business complies with the IT rules and regulations.

For Proprietorship: A proprietorship firm is managed by a single person called the proprietor. Proprietorship is not a separate legal entity, that is, both the proprietor and the business are the same. For this, ITR filing for a proprietorship is the same as that of the proprietor. Proprietors are needed to file IT returns year after year. The procedure is no distinct from that of individual income tax filing in India.

For Partnership: As per the Income Tax Act, all partnership firms are treated as separate legal entities and are applicable for tax rates that are on par with LLPs and companies registered in India. Irrespective of profit or loss, partnership firms are wanted to do ITR filing. If the firm has been commercially dull with no registered income, a NIL income tax return should be filed within the specified date.

For LLP: All Limited Liability Partnerships are considered separate legal entities and their income tax rate is similar to that of all companies registered in India. The Income Tax Act states that all LLPs must file their tax returns irrespective of the loss or gain they have caught in that year. If the LLP has seen no market activity or registered income, then a NIL income tax must be quickly filed.

For Company: All varieties of business structures like Private Limited Company, Limited Company, Limited Liability Partnership Company, One Person Company are listed under the Ministry of Corporate Affairs. All such firms are mandatorily needed to file IT returns as prescribed by the Income Tax Act. Any business that is registered with the Government of India and operating on Indian soil is needed to filing IT returns. This is equally suitable for those companies that have been asleep with no business activities and no registered income or expenses.

SK Tax Law Firm is one of the best ITR filing services provider. We believe in saving your time by taking the burden of financial load off your shoulders. SK Tax Law Firm is a platform which has dedicated and experienced professional for online tax filing. Our team of taxation experts are a phone call away, should you have any queries about the process. But we will always try to ensure that your doubts are cleared before they even arise. We are offering quality assured income tax return services to our customers at very competitive prices in the market. Apart from this, for filling your income tax return form, we help you dedicatedly. We maintain all your financial work by prioritizing and estimating it innovatively. We know the concern of your security and hereby promise to keep all the information private as your concern is our concern. You can reach us if you face any problem at +91- 9719586772, send your query at info@sktaxlawfirm.com.