ITR ONLINE

ITR Filing Online, SK Tax Law Firm have established ourselves as the leading enterprise, actively committed to providing this service. Our company provides legal help to the customer with a motive to resolve their ITR issues at a go. We assure our clients with the best provided ITR filing service with good quality. Our team consists of expert CA, along with a diligent team of other specialists, all under one roof. They provide the solution to all the individual, business person, corporate body, and others to get better help for the issues faced by them in their ITR return.

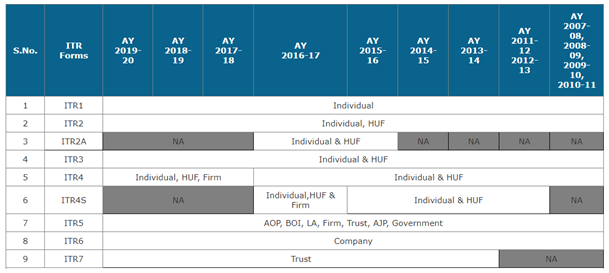

Every person who collects money exceeding a specific amount is subjected to pay government tax known as Income Tax. The income earned by a person can be through salary, income from mutual funds, interest from savings, sale of a property, profit from a business, and professional income. The tax paid or deducted on these revenues is called income tax. The union budget pre decides the rate of income tax at the beginning of every year. ITR or e-filing income tax is a form that one must fill and submit it electronically to the income tax department. The form requires you to give details on your revenue and taxes. The income tax e-filing forms are in different formats depending on the category of your income earned. The ITR should be filed every year within the specific dates and the income tax department of India has also decided various forms for it such as ITR 1, ITR 2, ITR 3, and ITR 4S, ITR 5, ITR 6, and ITR 7. If you have paid excess tax through a particular year, you will be eligible for an income tax refund, which is directed to the IT department’s calculations and analysis.

Form 16 is a certificate issued by an employer, to you when the tax deducted at the source has already been subtracted from your salary and deposited to the IT department. Form 16 consists of all the data that you would require when preparing and filing your online income tax return, which will cover the deductions. Form 16 is issued every year by the employer of the relevant financial year. You can directly upload the form and quickly complete your ITR filing online with us.

Yes, it is compulsory to file the ITR and if you did not do the same it will claim penalty and also will hamper your chances of getting a visa for travel purposes and the loan or property registration.

After successfully applying your income tax return, you get an acknowledgment from the IT department called the Income Tax Return-Verification or ITR-V. You get a mail on your registered e-mail ID from the Income Tax Department holding the ITR-V.

Deadlines for filing ITR changes from time to time by the government. You can e-file your tax returns any time before the deadline, but it is always better to e-file early to avoid the rush and heavy website traffic in the last month. Apart from this, you should file your ITR timely to avoid penalties.

We, SK Tax Law Firm are providing a range of ITR filing services. Our tax consultant will guide and assist you more on ITR return and the benefits that come along with it and help you with the correct form which is applicable and with the exact time. SK Tax Law Firm will help you to file the income tax e filing within the due date to avoid penalty. Our professionals are available which helps to e-filing income tax returns online. Most of the persons choose the wrong form, our professionals will help you to pick the correct IT online return form. You can reach us if you face any problem at +91-9719586772, send your query at info@sktaxlawfirm.com.